- #Unreimbursed business expenses how to#

- #Unreimbursed business expenses software#

- #Unreimbursed business expenses professional#

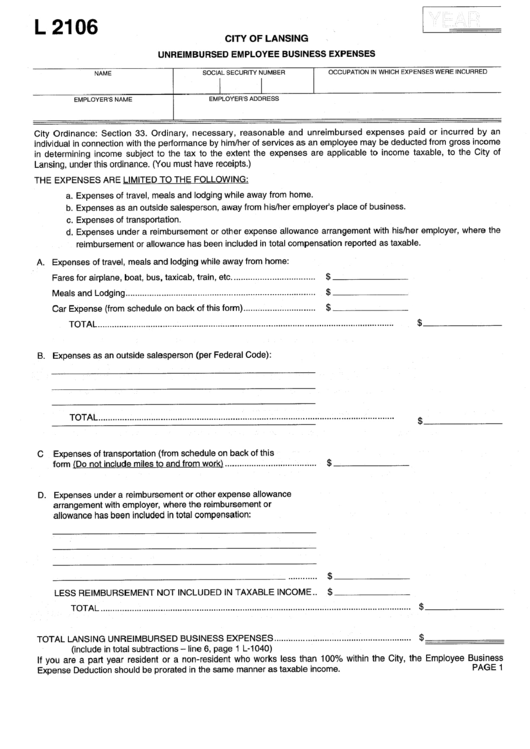

If you purchase these items yourself, they may be classified as unreimbursed business expenses.

#Unreimbursed business expenses software#

This coverage extends to office supplies, computer equipment, and even the software you might need to perform your daily responsibilities. If used for essential business purposes, your tools and supplies count as business expenses. Here are some of the most common examples of expenses that you might incur as part of your job: Tools and supplies To be clear, an "ordinary expense" is anything that is common and accepted in your trade or industry.

#Unreimbursed business expenses how to#

Here’s what you need to know about unreimbursed business expenses, including who can deduct these expenses from tax returns and how to do it: What are unreimbursed business expenses? Unfortunately, most employees can’t deduct unreimbursed employee expenses on their income tax return, which means that if they aren’t reimbursed by their employer, they’re out of luck. But when employers fail to pay their employees back for these expenses, it’s known as an unreimbursed business expense. Typically, business owners reimburse their employees when they incur a necessary expense in the workplace.

#Unreimbursed business expenses professional#

In this case, total expenses must be no more than £1,000 (or up to £2,500 for professional subscriptions). Sometimes HMRC will give relief over the phone. These employee can make a claim for expenses on the tax return. Some employees, such as higher rate taxpayers and company directors, normally need to submit an annual tax return. You can ask HMRC to arrange this for you by contacting your employer’s tax office. Some employees are given tax relief for particular recurrent expenses – such as professional subscriptions – through their PAYE coding. If your claim is for £2,500 or more, you will need to register for self assessment and complete a tax return (phone the self assessment helpline on 03). If you have tax-deductible work expenses which have not been reimbursed by your employer, and your allowable expenses are under £2,500, you can make a claim for tax relief using Form P87. If you use your own vehicle for work you should look at.

A good place to start is by looking at the HMRC website.

You will have to decide if the expense is allowable as a deduction for you as an employee.

0 kommentar(er)

0 kommentar(er)